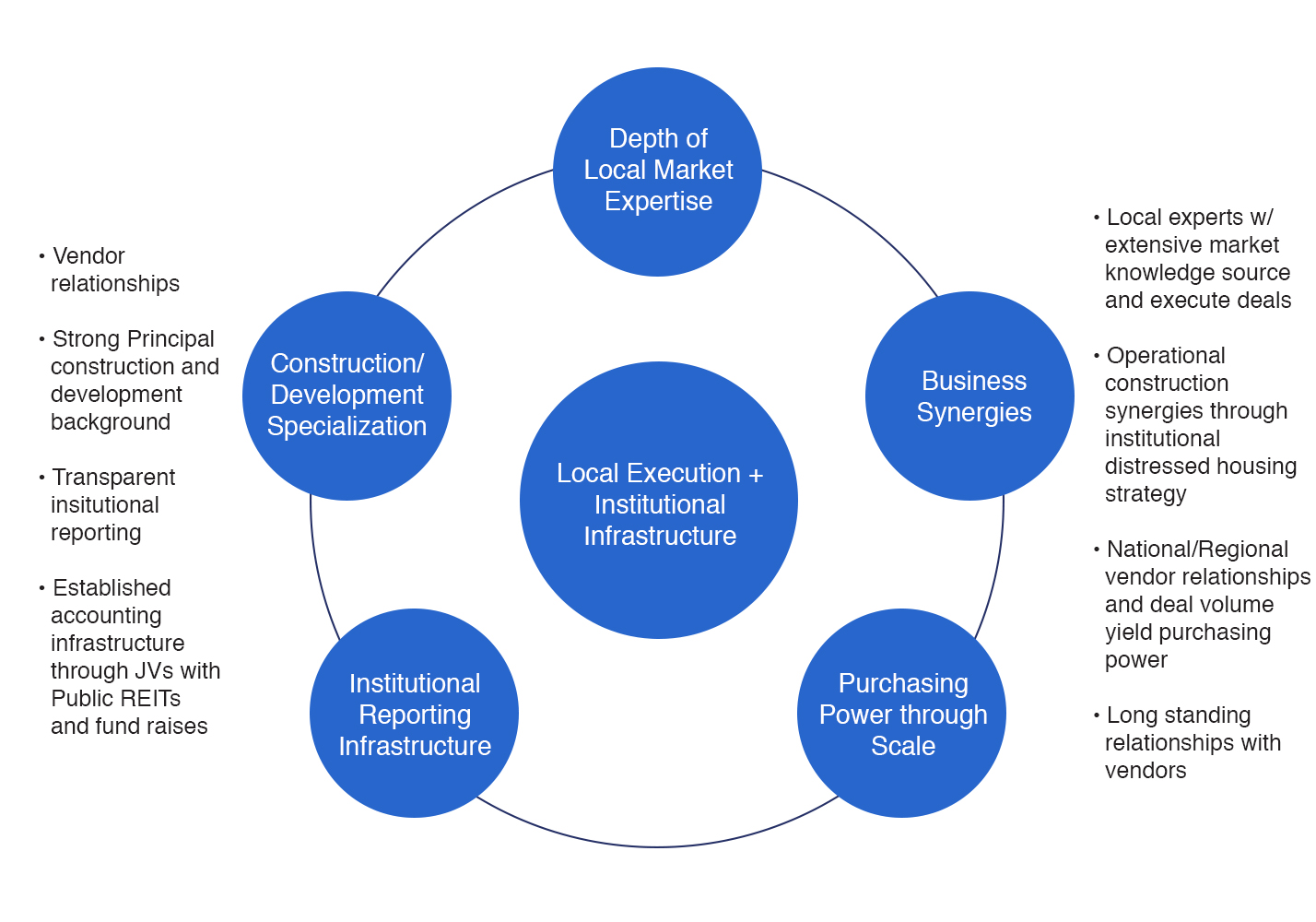

We methodically approach every business and investment from a “top down” global perspective in search of macro trends that offer opportunities to generate outsized returns through operationally-imposed value creation, or capitalizing on real estate market inefficiencies. Then through the partners’ extensive operational experience in construction, development and management, we assess our business strategies from the “bottom up” to identify niches or opportunities that allow us to leverage our resources and expertise to develop a platform that executes our chosen strategies and investments on behalf of our capital partners.

We view ourselves as housing experts with a multigenerational involvement in the housing sector, be it multifamily investment, single family investment or residential development. Broome Capital’s chosen strategies are operationally synergistic and have one common denominator: housing demographic drivers. Broome has evolved to become a platform that offers large institutions and family offices the ability to invest in smaller to mid-sized deal sizes that yield higher returns due to relatively less competition compared to large institutional quality deals. The challenge for our capital partners to invest in these lucrative smaller investments with equity check sizes under $10mm has always been simply too much resources and work are consumed for too little of an investment; Broome Capital is the solution to this impediment.